Michigan Auto Reform – Effective July 2, 2020

Bodily Injury Liability

New bodily injury liability limits will automatically be increased to $250,000 per person/$500,000 per accident, and $10,000 of property damage liability. You do not need to sign and return the liability form if you accept these coverage limits, or if you already have higher limits. If you have higher limits they will remain in place automatically. If however, you would like lower bodily liability coverage you need to complete and sign the liability form and return it to your insurance company.

The new Auto Insurance Reform Law presents a greater risk of being sued if you are at-fault in an accident. With the new law, you can now be sued for the uncovered medical expenses of an injured person. Carrying lower bodily injury liability limits can be a great financial risk to you and your family. We recommend carrying higher bodily injury liability limits, and consider adding a personal umbrella liability policy as well.

Limits are per person, per accident

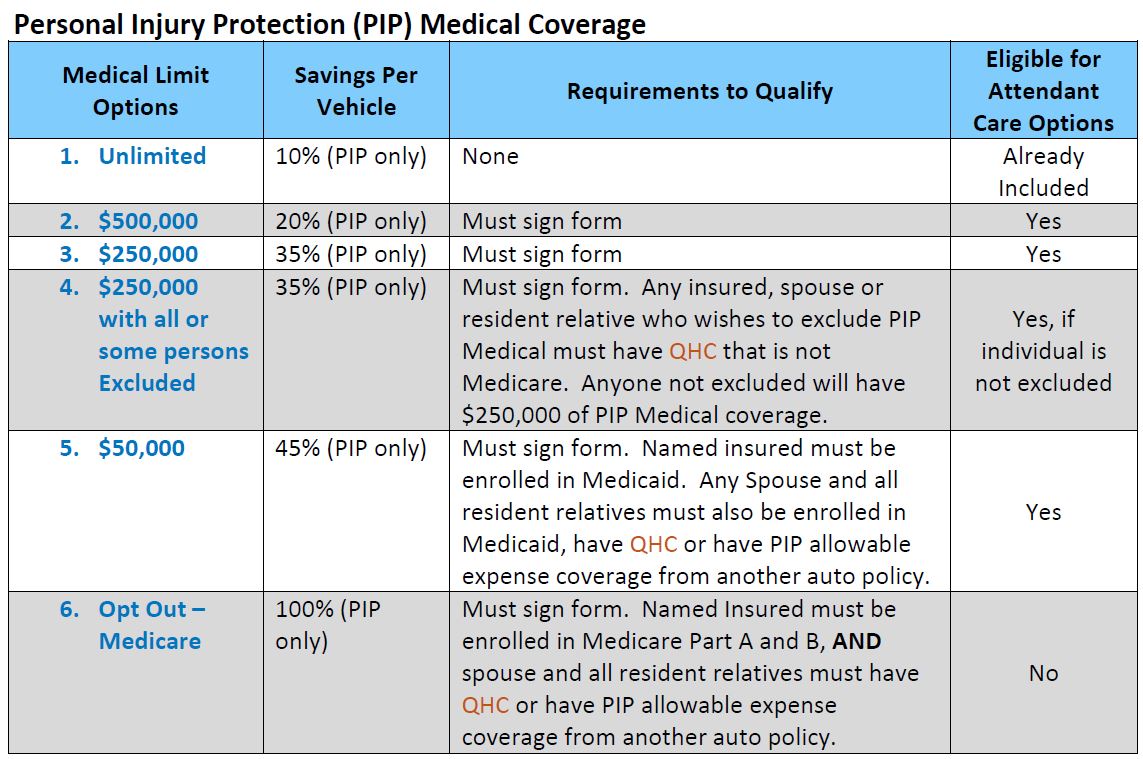

Qualified Health Coverage (QHC) – health insurance that does not exclude or limit coverage for injuries related to auto accidents, and the annual deductible is $6,000 or less per individual.

Excess Attendant Care Option – Attendant care coverage provides assistance to people with daily activities they can no longer perform themselves due to injuries caused in an auto accident. This coverage is available for those who are not excluded from PIP Medical. If you choose to Opt Out, you cannot purchase the coverage. If you choose Unlimited, coverage is automatically included with no limit.

Types of services that are covered under Auto PIP but NOT covered by health insurance or Medicare: If opting out of Auto PIP medical, many health insurance policies and Medicare DO NOT provide coverage for attendant care, custodial care, wage loss, other benefits such as modifications to your home or auto, and may also limit rehabilitation benefits. It is also important to remember that your health insurance or Medicare will still require co-pays, deductibles and co-insurance that your auto policy may not require.

Who’s Not Covered under PIP – Changes to the how personal injury protection is paid out. Coverage no longer extends to the named insured’s NON-relatives who live in the household, or to relatives who do NOT reside in the household, even if listed as drivers.

Questions

- Are there any drivers listed on your policy that do not reside with you?

- Are there any individuals who live in your home who are not related to the named insured on your policy? (regardless of whether they are named as a driver on your policy)

- Are there individuals who reside with you that you have not disclosed to your insurance company or agent?

- Does anyone who is not listed as a driver on your policy have regular use of any of your vehicles?(regardless of where they reside)

- Are any of your vehicles used for business transportation purposes such as Uber, Shipt, Grubhub?

If the answer is “Yes” to any of the above questions, your policy may provide limited coverage or no coverage in the event of a loss. We want to be sure you are properly covered. It is important that you contact Combined Insurance Agencies to discuss.

Mini Tort (Special Tort Liability) – Coverage increases from $1,000 to $3,000 automatically on 7/02/2020. Mini tort pays for damage you do to another driver’s auto. Example: the other driver (not at fault) has no collision coverage or a high deductible. Michigan Law holds you responsible for up to $3,000 of damage to the other driver’s auto. Your mini-tort coverage will pay on your behalf.

More information on the State of Michigan website: https://www.michigan.gov/autoinsurance/

The CIA Staff is ready and happy to assist. Please contact us via email or phone at your convenience.

Combined Insurance Agencies has made every attempt to ensure the information contained in this Summary and Q&A is accurate. For specific language please refer to your auto insurance policy as well as state statutes, laws and regulations.