Beginning July 2, 2020 drivers will have options for Personal Injury Protection (PIP) medical expense coverage amounts.

Seniors will have the option to completely opt-out of automobile PIP medical expense coverage if:

- The insured driver has coverage under Parts A and B of Medicare, AND

- The insured driver’s spouse and any resident relative has Medicare qualified coverage, or has PIP medical expense coverage under a separate auto insurance policy.

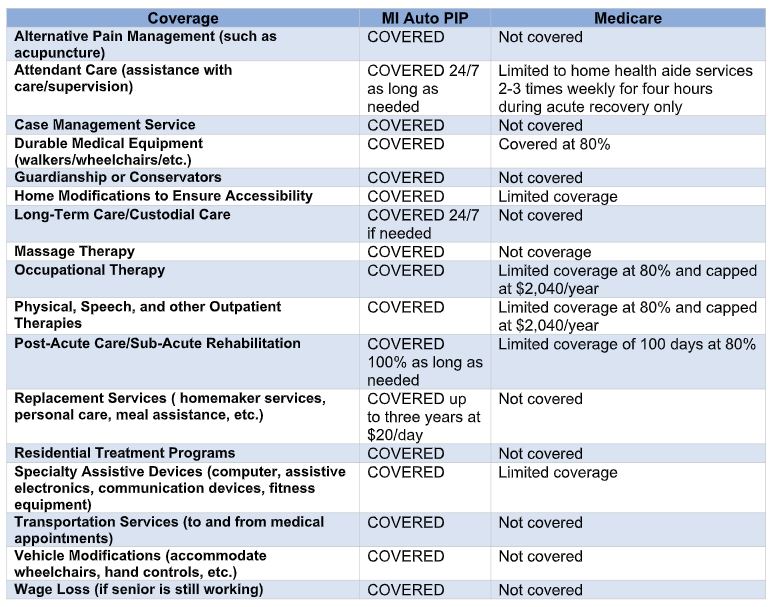

Please be aware that Auto Personal Injury Protection (PIP) provides much broader coverage than Medicare for expenses resulting from an auto accident.

Consider your decision to keep or opt-out of your unlimited PIP auto insurance coverage. Please review the chart below.

The CIA Staff is ready and happy to assist. Please contact us via email or phone at your convenience.

Combined Insurance Agencies has made every attempt to ensure the information contained in this Summary and Q&A is accurate. For specific language please refer to your auto insurance policy as well as state statutes, laws and regulations.